THE FORMATION OF THE SYSTEM OF RISK MANAGEMENT AT THE ENTERPRISES OF SMALL AND MEDIUM BUSINESS

Abstract

In the conditions of the increased turbulence of external environment the risk management is a key aspect in activity of any organization functioning in market economy. It is connected with the fact that risk factor arises in various fields of activity, and timely identification, the analysis and adoption of the relevant decision on a way of management of this or that risk, allows the organization to avoid the crisis phenomena and by that is both the protective mechanism, and a factor of success of the company. In this regard, the question of the organization of activities of risk management at the enterprises of small and medium business becomes one of the most actual and requiring special attention as they are especially involved in risky activity.

Keywords: risk, risk management, classification of risks, management, small business, medium business

Introduction. Modern human activity conditions are characterized by the constant growth of the quantity of information, complexity of relationships within the social system, and in relations with the environment. At the same time there is the acceleration of globalization, scientific and technological development, the scale of consumption of natural resources is increasing. This means that more and more factors influence the nature and direction of human activity, increasing the unpredictability of this influence. As a result the level of uncertainty of development is constantly increasing, it becomes more difficult to predict the results, formulate goals and implement actions to achieve them. All this leads to the need to pay serious attention to the risk management.

Formation and development of market economy in the Russian Federation has caused interest in questions of consideration of risk in economic activity of businessmen, to the theory of risk and have provided development of the modern domestic theory of enterprise risk. Scientific developments of domestic authors in the field of research of risks differ in a practical administrative orientation and as shows the analysis, attach the increasing significance to judgment of risk as about the possible danger taking place to be in the transaction or failure.

Studying of questions of risk management has fundamental value for the enterprises of small and medium business since owing to action of a large number of factors of unstable external economic environment, they are especially involved in risky activity, and consequences of risk situations can become for them irreversible.

The main part. Risk management became interested person from the very beginning of the development of economic and trade relations, when there was a need to reduce the negative impact of uncertainty on economic activity.

The first analysis of risk management issues on a scientific basis was carried out in the framework of economic theory (political economy). Representatives of classical school (A. Smith, J. Mill) in structure of the enterprise income have selected such article as «a payment for risk». Was considered that the businessman always puts a certain sum which has to provide compensation of losses in case of realization of risk in profit. And the high probability of such losses, the big size of profit is intended for compensation of risk.

In literature there are various treatments of concept of risk, in particular it is possible to give the following:

- the risk is a possibility of a deviation of the actual result from expected;

- the risk is a potential danger;

- the risk is a threat of loss of control over a situation, activity;

- the risk is an event with negative consequences, losses;

- the risk is an action in hope for luck, good luck etc.

On the basis of synthesis of various formulations it is possible to give the following definition: the risk represents uncertainty in the course of achievement of a goal, and in more applied plan the risk is a probability of emergence of losses, not achievements of the planned results, deviations of the course of processes from the planned scenario [5].

We will study in more detail risk factors, that is those conditions and circumstances as a result of which the events leading to realization of risk are shown. It is possible to allocate three main groups of factors:

- incompleteness and uncertainty of information on external and internal environment (here a special role is played by time factor: what for more remote period has intended the made decision, the it is more than opportunities for realization of various unforeseen events and consequently, the risk is more);

- limited ability to perceive and process this information the person responsible for decision-making, a control system in general;

- the casual or purposeful actions of external forces and objects of environment complicating achievement of goals.

Speaking about the importance of risk in activity of the enterprises of small and medium business, it is worth noticing that the risk can't be considered only as the negative phenomenon. The role which is played by risk in functioning of these enterprises and economies in general is shown, first of all, in his functions. It is possible to distinguish from them destructive and constructive functions.

Destructive consequences take place in case of realization of this or that risk when the businessman sustains unforeseen losses. Besides, negative impact amplifies if an opportunity (even very insignificant) obtaining benefit in the conditions of uncertainty induces people to adventurism and unreasonable expenditure, or, on the contrary, when fear of probable losses leads to excessive suppression of business activity.

Constructive function of risk is that understanding of his existence forms at heads higher level of responsibility and disciplines, stimulates the activity aimed at safety, increase of stability of work of the enterprise.

Positive impact of risk on subjects of economy can be considered from a position of the fact that the most profitable projects are, as a rule, realized in the conditions of the increased uncertainty. Therefore, the aspiration of businessmen to receiving additional profit demands acceptance of additional risk which in this case becomes a profitability growth factor [5].

Also constructive role of risk is shown in his protective function which is considered in several aspects. First, throughout all historical development people constantly looked for and improved ways of protection against risk. Today problems of development of effective ways of ensuring steady economic activity are especially actual. Secondly, at the present stage of development the risky projects sent to search and introduction of innovations are stimulated with the state by means of legal protection.

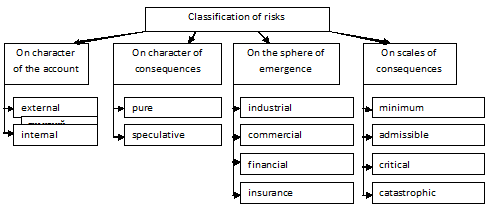

The effectiveness of the risk management system is largely determined by its systemacity (classification). Under risk classification refers a process of distribution of risks to various categories, systematization of risks for the purpose of their further studying. It creates opportunities for effective application of the corresponding methods of management of risk.

It is possible to classify risks in business by different classification signs: to the sphere, reasons and level of emergence; to functional types and branches of business, systemacity and duration of influence, admissibility level, etc.

Figure 1 shows the most common classification of risks in the literature.

Fig. 1. Classification of risks

Рис. 1. Классификация рисков

Research has shown that in modern literature there is no uniform approach in classification of risks, at the same time various authors classify risks on the basis of various classification signs. The offered classifications of risks don't consider specifics of the Russian business and instability of external environment. It is their major disadvantage. Russian business environment is influenced by a number of general economic and specific risk factors. General economic risks inherent in the business in any economic environment, while specific are characteristic of the Russian economy, the particular region and type of business organization.

For example, the enterprises of small and medium business are especially involved in risky activity that is connected with the nature of small business. Usually these enterprises meet different types of risk, as a rule, at a stage of preparation of contracts and pre-sale efforts.

The main types of risk faced by small and medium-sized enterprises are the following:

- risk of the competition (aggressive actions of competitors, besides, of the enterprise of small and medium business are limited in the choice of forms and methods of competitive fight);

- financial risk (the enterprise of small and medium business get access to financial resources under rather high percent or under guarantees (for which it is necessary to pay) and, as a rule, for short term that raises the price of activity of these enterprises and deprives of them the economic advantages connected with economy on the sizes);

- time risk (manufacturing small and medium-sized enterprises need time for an exit with the product to the market, and for innovative (venture) small enterprises such time is considerable and can take several years that leads to increase of uncertainty of results as essential changes in a market demand, etc. are possible)

- cost (expensive) risk (the cost of initial materials for manufacturing small and medium-sized enterprises is also subject to uncertain changes therefore considerable fluctuations of their expenses and profitability (financial results) are possible;

- need for special forms of communication with investors (banks) for business development (the enterprise of small and medium business use the production equipment which is expensive to purchase at once, or it is required only for a short time a production cycle);

- production risk (decrease in demand from the main consumers);

- administrative risks (negative consequences of interaction with authorities, adverse changes in the tax law or an order of licensing of economic activity).

The process of risk control, set of the administrative decisions directed to decrease in probability of emergence of adverse result and minimization of possible losses in system of the economic relations are called a risk management [2].

For the first time the concept of a risk management it is mentioned in article published in the American magazine in 1956. The main idea of the publications was that the company in order to reduce the economic losses have to use risk management specialists. Especially intensive reflections about risk became since the second half of the 20th century. To predict how it will behave in the company at risk,, methods of mathematical statistics were used. In a business environment the risk management has begun to win popularity in the 1970th years. At this time services in rendering consultations in the field of a risk assessment arose, and it was focused on influence of factors of economic instability in one country or another.

As for Russia, it can be said that the concept of risk management is in its infancy. Unlike foreign practice, at many domestic enterprises the risk management is considered the specialized and isolated kind of activity and is in competence of certain structures.

However, due to the fact that Russian companies as well as foreign companies are influenced by numerous risks, current trends of development of a risk management as means of protection of business activity attracted the attention of domestic researchers and businessmen more and more in recent years.

And if before all occurring in the enterprise risks were considered and studied as an individual not interconnected elements that made it impossible to compare them with each other and analyze the results obtained, that in recent years the approach to risk management process has changed significantly, which immediately led to the formation of a new model risk management, which comprehensively examines the risks of all departments and areas of the organization.

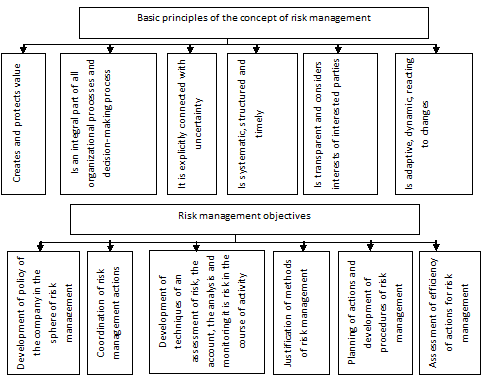

The system of theoretical and methodological approaches to defining the essence, content, goals, objectives, principles and risk management methods make the concept of risk management [6]. Consider this concept taking into account specifics of activity of the enterprises of small and medium business (fig. 2).

Fig. 2. The concept of the risk management for the enterprises of small and medium business

Рис. 2. Концепция риск-менеджмента для предприятий малого и среднего бизнеса

Restriction of the concept is that it is impossible to provide all risks. Also risk situation can not always lead to loss of means. There is a probability that the risk can lead to success and winning of the project.

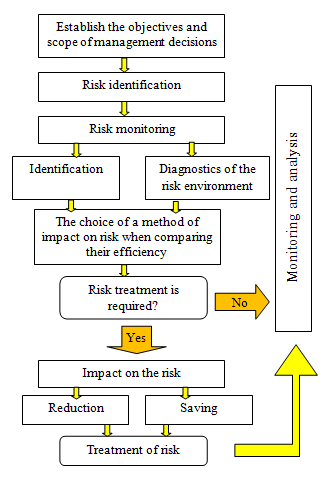

Studying modern risk management process, it is possible to allocate its basic elements (fig. 3). These include: exchange of information and consultations; establishment is more whole; identification of risk; analysis of risk; comparative assessment of risk; general assessment of risk; processing of risk; monitoring and the analysis of the done work.

Formation of the risk management system at the enterprise should be linked to the overall control system. Risk management strategy is primarily determined by the nature and scope of the enterprise. For example, the design and development process of risk management in the organizations of small and medium business it is necessary to consider:

- mission, strategy, policies and objectives of the organization in the field of risk management;

- characteristics of manufactured products and services rendered by the organization;

- basic processes and management processes of the organization;

- installed and used methods of analysis and risk assessment;

- legal requirements;

- operating conditions of production.

Fig. 3. Algorithm for the risk management process

Рис. 3. Алгоритм процесса управления рисками

Reviewing the activities of small and medium enterprises (SMEs), we can say that because of the nature and specificity of Russian conditions, it is associated with a significant degree of uncertainty of economic activity. Given the instability of the macroeconomic environment and the Russian socio-economic conditions of this uncertainty is likely to increase than to decrease, making it more important task of identifying risks and resilience. Small and medium business has its own characteristics that must be taken into account in the organization and implementation of risk management [1]. The peculiarity of risk management for SMEs due to the following circumstances:

- the majority of small and medium-sized enterprises is a diversified, which determines their susceptibility to many types of risk;

- for the analysis and management of risks requires much more time than in larger enterprises, due to the fact that SMEs have limited staff, which does not allow the company to create a specialized structure, or highlight the position of risk manager;

- because of small financial reserves of SMEs are significant risks are critical and have devastating consequences;

- tools to emerging risks available to the SMEs, often inferior to the scale of emerging threats;

- in the activities of SMEs there is a significant probability of insurmountable risks caused by a high degree of uncertainty and variability in the Russian economic system.

Conclusion. Thus, it is possible to make a conclusion that the ability to effectively influence the risk gives the company the ability to operate successfully, to have financial stability, high competitiveness and stable profit. The head of the organization should not avoid meeting with the inevitable risk, and should strive to anticipate it and be reduced to an acceptable level possible. In this case, affect the quality and efficiency of the entire control system will be able to introduction of risk management system.

Risk management is a key process of the organization. The effective development and implementation of the process of risk management is an important tool for continuous improvement of the organization. risk management process covers various aspects of the work with risk - from identification and risk analysis to assess its admissibility and to identify potential risk mitigation opportunities through the selection and implementation of appropriate action.

Despite importance of small and medium business and an urgent need in instruments of risk management, this direction is developed in Russia rather poorly. Partly it is connected with difficulty and versatility of a problem, partly – with the fact that long time experts in the field of risk management were focused on the large companies. Today for the enterprises of small and medium business it is possible to allocate the following priority directions:

- development of classification of risks of small and medium business taking into account their specifics;

- creation of system of an assessment of risks for small and medium business or adaptation of already existing;

- development and automation of instruments of risk management;

- adaptation of instruments of financial and internal revenue service by risks for the Russian small and medium business.

Article is made within the framework of President Grant MK-4882.2016.6 «Modeling of system of a risk management of small and medium business in the conditions of the increased turbulence of external environment».

Статья выполнена в рамках Гранта Президента МК-4882.2016.6 «Моделирование системы риск-менеджмента малого и среднего бизнеса в условиях повышенной турбулентности внешней среды».

Reference lists